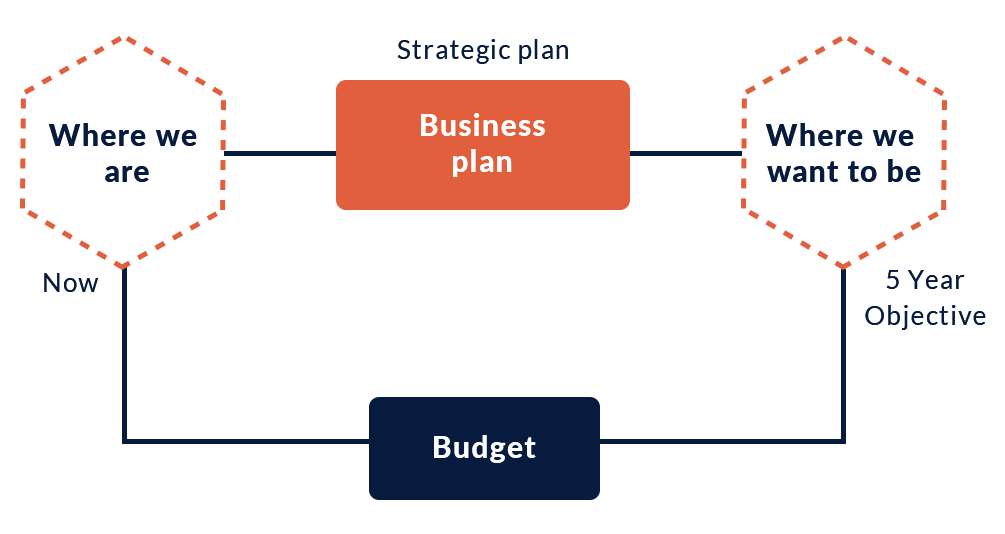

Budgeting is the tactical implementation of a business plan. To achieve the goals in a business’s strategic plan, we need a detailed descriptive roadmap of the business plan that sets measures and indicators of performance. We can then make changes along the way to ensure that we arrive at the desired goals.

A robust budget framework includes an operating budget, a capital expenditure budget, and a cash budget. Combined budgets produce budgeted income statements, balance sheets, and cash flow statements.

Income, salary, benefits, and non-salary expenses are among the day-to-day operating expenses. Operational budgets are used by companies to plan their activities over time, typically a quarter or a year.

Typically, capital budgets are requested for the purchase of large assets such as property, equipment, or IT systems, which place a heavy strain on a company's cash flow. In capital budgets, funds are allocated, risks are managed, and priorities are set.

The cash budgets of businesses provide an explanation of how payments are made and how revenue is received. Management can assess the magnitude of additional capital and financing needed by using an effective cash budget.

Almost all large companies begin the budgeting process four to six months before the fiscal year begins, while some may take an entire fiscal year to finish. Monthly budgets and variance analyses are the norm in most organizations. To finally implement the budget, the company follows a series of steps starting with the initial planning. In addition to communication, various processes include setting objectives and targets, developing a detailed budget, assembling and revising the budget model, and reviewing and approving the budget.